Capital Structure Analysis: Key Financial Indicators in Manufacturing

Main Article Content

Antar MT Sianturi

Magda Siahaan*

Arya Pradipta

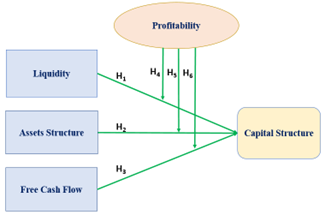

This study focuses on how liquidity, asset composition, free cash flow, and profitability impact capital structure. It also explores how profitability can affect the relationship between liquidity, asset composition, and free cash flow with capital structure. The study focused on collecting information from 50 manufacturing firms that are publicly traded on the Indonesia Stock Exchange over a period of three years, totaling 121 data points. The data analysis method uses multiple linear regression with the help of the Statistical Package for Social Sciences program. The study's findings suggest that there is some evidence to support the idea that liquidity has a negative impact on capital structure. The asset structure variable and the free cash flow variable do not affect capital structure. The profitability variable is proven to strengthen the negative effect of liquidity on capital structure. Nevertheless, it is unable to enhance the favorable impact of the composition of assets and the detrimental impact of surplus cash flow on the firm's financial structure. According to the research, it is suggested that the board members and executives of the organization should be responsible for optimizing resources and driving up the company's earnings; investors who want to invest in manufacturing companies should do an investment assessment.

Akhmadi, A. (2023). The Impact of Liquidity Moderation: Studies on Transportation Subsector Service Companies Listed on the IDX. Sriwijaya International Journal of Dynamic Economics and Business.

Akmalia, A. (2022). Pengaruh profitabilitas dan likuiditas terhadap struktur modal perusahaan. Neraca.

Barclay, M. J., & Smith, C. W. (2005). The Capital Structure Puzzle: The Evidence Revisited. Journal of Applied Corporate Finance, 17, 8–1. anticscholar.org/CorpusID:153342585

Bhattacharyya, N., & Morrill, C. K. J. (2015). Capital Structure: Theory and Evidence. Global Market Intelligence Research Paper Series. https://api.semanticscholar.org/CorpusID:155643729

Copeland, T. ., & Weston, J. F. (1989). Asset Pricing. In: Eatwell, J., Milgate, M., Newman, P. (eds) Finance. https://doi.org/10.1007/978-1-349-20213-3_6

Damayanti, D. A., Taujiharrahman, D., & Ghozali, I. F. (2022). Liquidity Ratio Analysis in Measuring Company Financial Health at PT. Indofood CBP Sukses Makmur Tbk. Journal of Sharia Finance and Banking.

Data, A., Alhabsji, T., Rahayu, S. M., & Handayani, S. R. (2019). Effect of Growth, Liquidity, Business Risk and Asset Usage Activity, Toward Capital Structure, Financial Performance and Corporate Value. European Journal of Business and Management, 9, 9–25.

De Luca, P. (2018). Company Profitability Anaysis. In: Analytical Corporate Valuation. Springer, Cham. https://doi.org/10.1007/978-3-319-93551-5_2

Donaldson, G. (1961). Corporate debt capacity: A study of corporate debt policy and the determination of corporate debt capacity. https://doi.org/10.1080/758532828

Dwi, A. (2012). Faktor – Faktor yang Mempengaruhi Kebijakan Hutang (Perusahaan Manufaktur yang Terdaftar Di Bursa Efek Indonesia). Jurnal Keuangan Dan Perbankan Universitas Merdeka Malang, 16(2).

Effendi, S. E., & Siahaan, M. (2023). Pengaruh Ownership dan Faktor lainnya terhadap Nilai Perusahaan. Media Bisnis, 15(1), 89–102. https://doi.org/10.34208/mb.v15i1.2061

Frank, M. Z., Goyal, V. K., & Shen, T. (2020). The Pecking Order Theory of Capital Structure. Economics and Finance.

Hidayat, R., & Sudarno, S. (2013). Analisis Faktor-faktor Yang Mempengaruhi Struktur Modal Pada Perusahaan Manufaktur Terdaftar Di Bursa Efek Indonesia Periode 2007-2011. Diponegoro Journal of Accounting, 2, 332–343. https://api.semanticscholar.org/CorpusID:153599620

Infantri. (2015). Pengaruh Likuiditas, Profitabilitas Terhadap Struktur Modal Perusahaan Otomotif yang Terdaftar di BEI. E Journal Stiesia Surabaya.

Jensen Michael C. and William H. Meckling. (1976). Theory of The Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics, 3, 305–360. https://doi.org/https://doi.org/10.1016/0304-405X(76)90026-X

Jonathan, J., & Siahaan, M. (2023). Pengaruh Faktor Internal terhadap Nilai Perusahaan. Media Bisnis, 15(2), 309–318. https://doi.org/10.34208/mb.v15i2.2283

Joni, L. (2010). Faktor – Faktor yang Mempengaruhi Struktur Modal. Jurnal Bisnis dan akuntansi. Jurnal Bisnis Dan Akuntansi.

Kumari, P. (2021). Role of Capital Structure in Financial Performance of a Company. International Journal of Multidisciplinary.

Maulana, A. R., Siahaan, M., & Nauli, T. D. (2024). Internal Factors Within an Auditor Influence the Quality of the Audit. Journal of International Accounting, Taxation and Information Systems, 1(3), 159–167. https://jiatis.com/index.php/journal/article/view/62

Megginson, W. L. (2005). Toward A Global Model of Venture Capital? Journal of Applied Corporate Finance.

Mwaniki, G., & Omagwa, J. (2017). Asset structure and financial performance: a case of firms quoted under commercial and services sector at the Nairobi securities exchange, Kenya. Research Journal of Finance and Accounting, 8, 192–200.

Myers, S. (2001). Capital Structure. Journal of Economic Perspectives, 15(2), 81 – 102.

Purwanti, E. (2022). Liquidity level analysis of food and beverage companies. Urnal Ilmiah Manajemen, Ekonomi & Akuntansi.

Rakhmawati, A., Siahaan, M., & Siahaan, B. P. (2024). Factors Affecting Earning Management in Manufacturing Companies on Indonesian Stock Exchange. Current Advanced Research on Sharia Finance and Economic Worldwide (Cashflow), 3(4), 475–485. https://ojs.transpublika.com/index.php/CASHFLOW/article/view/1291

Riyanto. (2012). Dasar-Dasar Pembelanjaan. BPFE.

Sahabuddin, Z. A. (2017). Asset Structure Impact on Capital Structure of Capital Market-Listed Firms in Indonesia and Malaysia. Journal of Finance and Banking, University of Merdeka Malang.

Sartono. (2014). Manajemen Keuangan Teori dan Aplikasi (empat). BPFE.

Siahaan, M., Nauli, T. D., & Siahaan, B. P. (2024). Can Internal Mechanisms Control Detect Corruption Through Fraudulent Behaviour ? AFRE Accounting and Financial Review, 7(1), 1–8. https://jurnal.unmer.ac.id/index.php/afr/article/view/11893

Siahaan, M., Suharman, H., Fitrijanti, T., & Umar, H. (2023). When internal organizational factors improve detecting corruption in state-owned companies. Journal of Financial Crime, 31(2), 376–407. https://doi.org/10.1108/JFC-11-2022-0292

Srimindarti, C., Ardiansyah, F. D. S., Hardiningsih, P., & Oktaviani, R. M. (2019). Profitability Moderate The Effect Of Firm’s Characteristic On Capital Structure. Jurnal Akuntansi.

Suastawan. (2014). Pengaruh arus kas bebas terhadap kebijakan utang dengan profitabilitas sebagai variable moderating. E Jurnal Universitas Udayana.

Suryani, A. W., & Sari, M. I. (2020). Dampak Non-Debt Tax Shield dan Resiko Bisnis Terhadap Struktur Modal Perusahaan Manufaktur Indonesia. Ekonomi Bisnis, 25(2), 108. https://doi.org/10.17977/um042v25i2p108-119

Syarifah. (2021). Effect of Earnings Management, Liquidity Ratio, Solvency Ratio and Ratio Profitability of Bond Ratings in Manufacturing : (Case Study Sub-Sector Property and Real Estate Sector Companies listed on the IDX Indonesian). International Journal of Business, Economics and Social Development, 2(2), 1–9. https://journal.rescollacomm.com/index.php/ijbesd/article/view/144

Thomas, K. T., Chenuos, N. K., & Geoffrey biwott. (2014). Do Profitability, Firm Size and Liquidity Affect Capital Structure? Evidence from Kenyan Listed Firms. European Journal of Business and Management, 6, 119–124.

Vogt, S. C., & Vu, J. D. V. (2000). Free Cash Flow and Long-Run Firm Value: Evidence from the Value Line Investment Survey. Journal of Managerial Issues, 12, 188.

Winarta, N. H., Siahaan, M., & Nauli, T. D. (2024). Non-Financial Companies: Earnings Management and The Factors That Influenced. Journal of Management, Accounting, General Finance and International Economic Issues(Marginal), 3(3), 819–832. https://ojs.transpublika.com/index.php/MARGINAL/article/view/1290/1118

Zadorozhnyi, Z.-M. (2018). @article{Zadorozhnyi2018ProblematicIR, title={Problematic issues relating to the quality of information used for accounting and management accounting of low-cost assets. Herald of Economics.